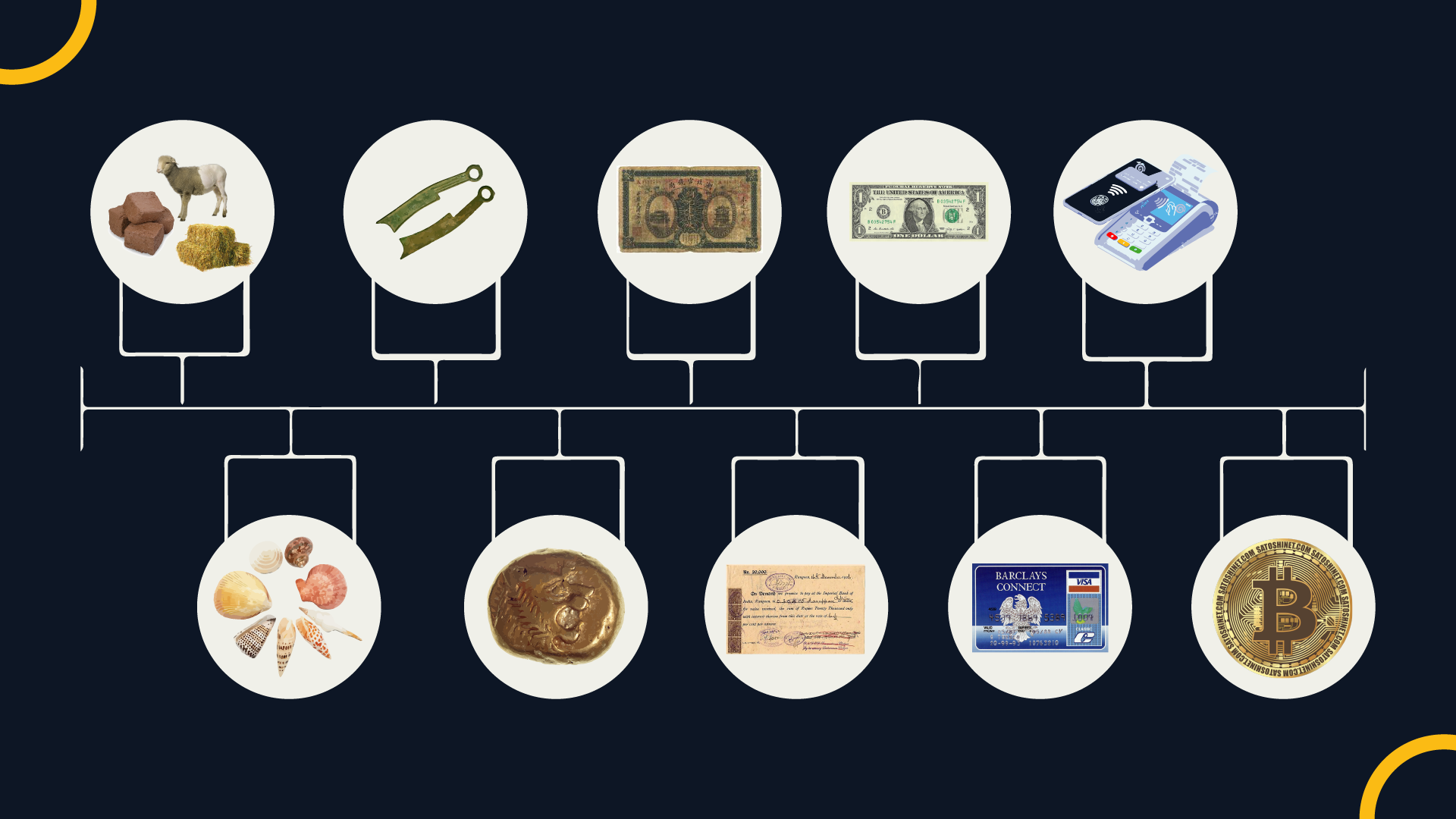

Money is one of the most influential inventions in human history and has been amended to make selling more accessible and efficient throughout history. Money has made it easier for people to exchange goods and services with today’s most common types of capital are coins, bills, credit cards, debit cards, and crypto. But how did payments get to where they are today?

Ancient Societies and the Development of Money

Money has been around for thousands of years, dating back to the earliest human civilizations. According to the most current findings, the Babylonians, Chinese, Indian, and Persian Empires were the first civilizations to use currency for trade. Trade routes connected different civilizations and helped spread new ideas about money and its benefits. As civilizations grew and expanded, so did the need for a more reliable form of money – but before money became a globally standard utility, humans exchanged goods in different ways.

Commodity Money

Using commodities, such as cattle, grain, and spices, as a form of money became a widespread practice; the availability of these commodities marked their value. In other words, supply and demand. For example, if a drought hindered a cattle-raising region, the monetary value of the cattle would decrease.

Unfortunately, this commodity-dependent system eventually yielded a significant problem. When it was time to pay a debt, debtors would find a way to return less. This instability led to settling debts with items less valuable than agreed upon. Due to these inconsistencies and a lack of checks and balances, commodity money was eventually controlled by governments and replaced by objects made of precious metals.

Controlling Money Supply

The first governments to control the commodity money supply were the ancient civilizations of Mesopotamia and Egypt. The government created and tracked who owned rings and bracelets made of precious metals. People would exchange their rings and bracelets for goods and services. The government would keep track of ring and bracelet owners, who were required to pay a certain amount to the government.

In each civilization, the rings and bracelets were standardized to ensure everyone received the same amount of money when they traded their items. The standardized coins made it easier to exchange goods and services. The government could also increase or decrease the amount of money in circulation, which allowed them to control the economy.

The Invention of Banking

The invention of paper money helped standardize the monetary system. Paper money was tied to gold and silver and was much easier to carry around. When people had large sums, they often kept their money in banks. A bank is a place where people store their money in a safe location.

In exchange for keeping their money in the bank, people earned interest. Interest is a fee the bank pays users for trusting and saving their money there. Interest rates are also applied to bank loans when a bank credits someone and, in exchange, charges interest. Banks also make it easier to exchange money between different people or countries – but usually at a high cost.

Electronic Money: 21st Century Payments

Bank-issued electronic money, such as debit and credit cards, has become very popular in recent years—banks issue debit cards, which draw funds directly from the person’s checking account. Credit cards are a type of loan that allows people to make large purchases without paying the total amount upfront. However, credit cards also charge high-interest rates, making them a risky financial decision for many people.

In the last ten years, crypto payments have grown in popularity due to time and cost-effective transactions around the globe. As opposed to depending on governments and banks to decide interest rates and money supply, the crypto market stands alone as one of the most appealing financial ledgers. Moreover, thanks to impenetrable and perfectly calculated blockchain technology, the crypto market gives users the liberty and transparency to control their funds. Because of this, the demand for crypto payments has skyrocketed, and many new technologies are keen to supply.

Crypto Payments

Transacting crypto is very simple but comes with some risks, which is why many companies are working to bypass crypto market volatility. For example, ForumPay’s crypto payment gateway allows crypto users to purchase goods and services without hindering the profits or payouts of merchants. Much like a crypto ATM, ForumPay uses instant price determination to convert crypto to cash when a purchase is made. Crypto-paying customers simply scan a QR code, and the merchant receives the cash equivalent amount in their bank account daily.

Learn more by visiting us at ForumPay today! And don’t forget to follow us on Instagram and Twitter for more on all things crypto!