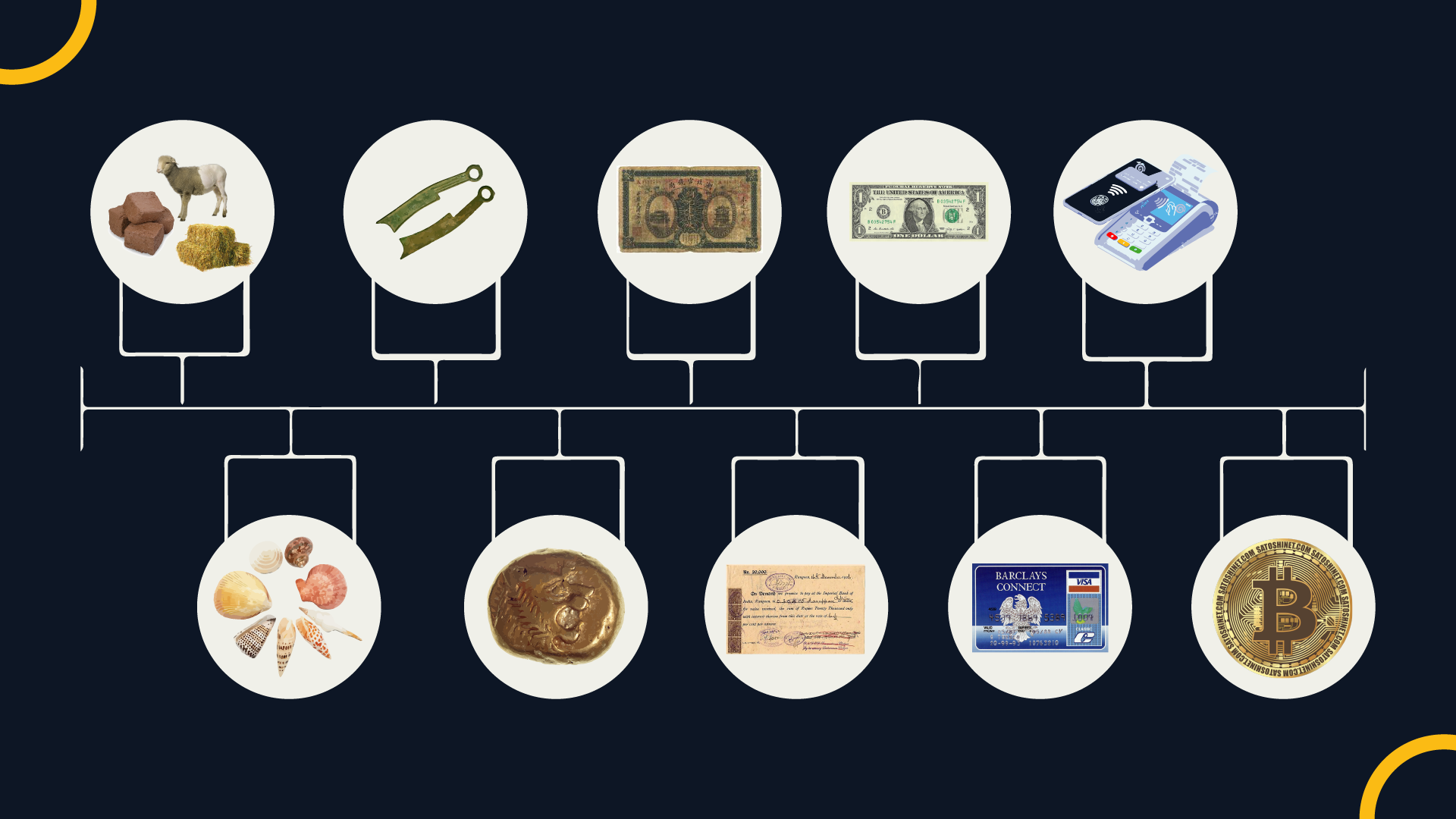

From bartering to paying with mobile phones, payment methods have gone through many adaptations. Sometimes we resist change and the unknown, but as our needs and environments evolve, so do the tools around us. Payment methods are no exception. With cryptocurrencies entering the mainstream every day, it’s only natural to wonder; are we entering the next phase of money evolution?

To understand the evolution of payment methods, it’s important to take a look at the history, characteristics, and purpose of money.

A Brief History of Money:

In some form or another, money – or currency- has existed for roughly 3,000 years. Before that historians believe there was a system of trading goods, known as bartering. Although simple in concept, bartering was not the best solution in practice as there was no set value for the product or service of one thing for another. Finding an accord for a fair trade was tedious and unreliable.

To combat the slow transactions, a form of currency was created.

- Roughly 600BC: Minted currency surfaced in Lydia (modern-day western Turkey) forged with images as denominations of different values to give ‘prices’ to goods and services.

- 11th -16th Centuries: Leaping forward some hundred years, in Europe currency was still used in the form of coins facilitating colonization efforts by using precious metals to mint various coin values. Eventually, paper currency was developed for ease of transport and treasury record calculations. As coins were abundant and inconvenient to stash, they remained circulating in communities with overseers. This resulted in the development of wealthy economies and inevitably a strong weapon of war.

- Early 20th Century: International trade boomed and people began to buy currencies from competing countries causing currency wars to arise. Competing countries would manipulate the value of each other’s currencies resulting in goods being too expensive to buy and reducing each other’s buying power until one outweighed the other.

- Late 20th Century: Credit cards and debit cards surface in the form of “plastic money” moving physical money to a secondary position and allowing banks to hold and distribute cash and permitted debt to people. Credit and debit cards make carrying money around easy and today it’s rare to find places that don’t accept these forms of payment.

- 21st Century: Just when plastic money seemed to be the ideal form to carry around money, smart mobile phones took the world by storm, and now mobile payments are the mainstream way of buying goods and services. Mobile banking, trading, and bookkeeping apps are abundant and available on one device as the primary source of payments today.

- Today: Decentralized finance is all the rage and cryptocurrency is the driving force. Crypto has no physical form and holds value by being hedged to an asset or simply by the investments of crypto consumers backed by a peer-to-peer network supported by impenetrable blockchain technology networks. Crypto is also carried through mobile devices and stored in digital wallets.

This market has boomed and now cryptocurrency is quickly being treated like traditional currency around the world, from making payments for everyday goods and services to withdrawing and depositing funds in crypto ATMs.

Characteristics of Money:

With years of volatility around cryptocurrency, some question whether it qualifies as money. And it does, here is why:

In order for money to be money, it requires…

- Durability: Must be strong enough to use over and over

- Portability: Easy to transport from one place to another

- Uniformity: One unit has no more or less value than the other

- Divisibility: Successful currencies divisible into smaller incremental units

- A Limited Supply: In order to maintain value, money needs a limited supply

- Acceptability: Successful currencies need to be accepted as a form of payment

Today, crypto hits all those marks. So why still so much hostility for it to break into the mainstream? It may be that there are some misconstrued ideas behind the purpose of money as a whole.

The Purpose of Money:

Simply, the purpose of money is to serve as a means of exchange. This allows people to obtain what they need to live or prosper and communities the opportunity to flourish economically.

Complexly, money has been used and abused in many horrible ways throughout history, creating a demand for security around it. Someone, something, or an entity to protect it, check it, track it, distribute it, and strategize with it. Unfortunately, that someone, something, or entity is hard to agree upon by everyone, whether a leader, government, corporation or bank. And despite justice systems and checks and balances, this causes a lot of turmoil and aggressive politics around money and how it should be used. With so much need for protection, storage, and distribution, with time individuals have not been able to achieve full visibility of their funds with so many factors and layers in the way. Never having full visibility or knowing the true value of their money.

Up Next: Cryptocurrency

Crypto, in a way, makes money simple again, giving investors full visibility and decision-making power of their own ledgers. And yes, learning about crypto and blockchain may seem intimidating, but many argue it is, indeed, the next step in the evolution of money. There are many resources available around the globe ready to assist anybody willing to learn about cryptocurrencies and blockchain technology.

To learn more about crypto ins and outs, feel free to check out these educational articles to help you get started.

Now that you are aware of this, there’s no doubt you’re wondering “what are the benefits of crypto?” and “what can I buy and sell with crypto?”… and you’re in luck! Find out in this article and more, and good luck on your evolutionary journey!

Don’t fall behind; start accepting crypto payments in your business! Visit our website ForumPay to learn more, speak with a sales representative, or read up on all things crypto! And don’t forget to follow us on Instagram and Twitter for more